By Chris King, Stock Alert Daily

The Nasdaq is home to some of the world’s most dynamic and forward-thinking companies.

But one of the things that makes the Nasdaq exchange so unique is that many of its companies can be misunderstood by the market. This creates opportunities for significant undervaluation…which savvy investors can take advantage of.

By identifying the hidden treasures within the Nasdaq – those undervalued stocks with extraordinary potential waiting to be discovered – investors can potentially rake in significant gains as those companies become more widely-known.

Many of the highest-upside stocks that tend to be undervalued are in lower-priced stocks…whose shares are currently trading for $5 or less.

What follows is a list of 4 undervalued Nasdaq stocks – each trading at $5 or less – that are currently well-positioned to deliver strong gains in the months ahead.

As always, be sure to do your own due diligence before investing in any stock to make sure it’s right for your financial situation and that it is consistent with your acceptable level of risk.

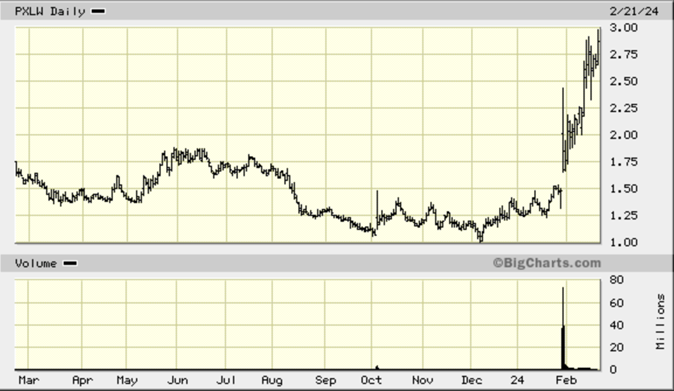

Top Undervalued Nasdaq Stock #1 – Pixelworks, Inc. (Nasdaq: PXLW)

Pixelworks, Inc. (Nasdaq: PXLW), together with its subsidiaries, develops and markets semiconductor and software solutions for mobile, home entertainment, over-the-air, cinema, and business and education markets.

The company provides image processor integrated circuits, including embedded microprocessors, digital signal processing technology, and software that control the operations and signal processing within high-end display systems; visual processor integrated circuits, for mobile devices; and transcoder integrated circuits which comprise embedded microprocessors, digital signal processing technology, and software that control the operations and signal processing for converting bitrates, resolutions, and codecs.

The company recently announced its financial results for the fourth quarter and fiscal year ended December 31, 2023. For that period, total revenue increased 25% sequentially, driven by record mobile revenue. And mobile revenue increased 44% to a record $11.9 million.

In addition, Pixelworks recently announced a multi-year agreement with Walt Disney Studios to bring initial collection of TrueCut Motion™ graded titles to select home entertainment devices through the Disney+ streaming service.

According to analysts’ consensus price target of $3.50, Pixelworks has a forecasted upside of 21.5% from its current price of $2.88.

Top Undervalued Nasdaq Stock #2 – Broadwind, Inc. (Nasdaq: BWEN)

Broadwind, Inc. (Nasdaq: BWEN) is a precision manufacturer of structures, equipment and components for clean tech and other specialized applications.

The company operates through three segments: Heavy Fabrications, Gearing, and Industrial Solutions. The Heavy Fabrications segment provides fabrications to various industrial markets. It offers steel towers and adapters primarily to wind turbine manufacturers. The Gearing segment provides gearing, and gearboxes and systems for onshore and offshore oil and gas fracking and drilling, surface and underground mining, wind energy, steel, material handling, and other infrastructure markets. This segment also offers heat treat services for aftermarket and original equipment manufacturer applications.

The Industrial Solutions segment provides supply chain solutions for offering instrumentation and controls, valve assemblies, sensor devices, fuel system components, electrical junction boxes and wiring, energy storage services, and electromechanical devices; light fabrication, inventory management, and kitting and assembly services; packaging solutions; and fabricating services for panels and sub-assemblies to combined cycle natural gas turbine market.

Broadwind, Inc. sells its products to the energy, mining, and infrastructure sector customers through its direct sales force and independent sales agents.

According to analysts’ consensus price target of $7.00, Broadwind has a forecasted upside of 166.2% from its current price of $2.63.

Top Undervalued Nasdaq Stock #3 – Carisma Therapeutics, Inc. (Nasdaq: CARM)

Carisma Therapeutics, Inc. (Nasdaq: CARM) is a clinical-stage biopharmaceutical company, focuses on discovering and developing immunotherapies to treat cancer and other serious diseases.

The company’s clinical and pre-clinical programs include CT-0508 and CT-0525 targeting HER2 overexpressing tumors; and CT-1119, a CAR-Monocyte for mesothelin overexpressing solid tumors.

Carisma Therapeutics has received a consensus rating of Buy from analysts with 5 buy ratings and zero hold or sell ratings. According to analysts’ consensus price target of $10.00, Carisma Therapeutics has a forecasted upside of 296.8% from its current price of $2.52.

Top Undervalued Nasdaq Stock #4 – Blink Charging Co. (Nasdaq: BLNK)

Blink Charging Co. (Nasdaq: BLNK) is a leading electric vehicle (EV) charging equipment and services provider in the United States. The company aims to accelerate EV adoption by providing reliable and affordable charging solutions. With a comprehensive network of charging stations, Blink is committed to making EV charging accessible to all.

Blink Charging Co. was founded in 2009 and is headquartered in Miami Beach, Florida. The company designs, manufactures, and operates EV charging equipment and software platforms for commercial and residential use. Its products include Level 2 AC charging stations, DC fast charging stations, and mobile charging solutions.

Blink’s charging stations are strategically located in high-traffic areas such as shopping malls, airports, hotels, and parking garages. Its target market includes individual EV owners, fleet operators, and property owners looking to provide charging services to their tenants and customers.

Blink Charging Co. has partnered with major automakers, including BMW, Nissan, and General Motors. In addition, the company has received several awards and recognitions for its innovative technology, including the CES Innovation Award and the Frost & Sullivan New Product Innovation Award.

In its third quarter, the company reported 152% growth in revenue and 167% growth in gross profit, both year over year.